Business Incentives

In a concerted effort to attract and retain quality employers, Christian County and its incorporated cities have developed an impressive array of incentive programs. These incentives are designed to provide companies locating within the County a competitive edge by reducing both startup and long-term operating costs. Ensuring the profitability of business is the foundation for a higher standard of living for all Christian County’s residents. The County also provides developmental assistance by qualified staff.

Local incentive, Real Estate tax abatement is available.

Christian County Enterprise Zone

Enterprise Zones are among Illinois’ most important tools to stimulate economic growth and neighborhood revitalization. The Enterprise Zone program depends upon a creative partnership between state and local government, businesses, labor and community groups to encourage economic growth in the areas designated as Enterprise Zones. In addition to state incentives, some local incentives include abatement of property taxes on new improvements, homesteading and shopsteading programs, waiver of business licensing and permit fees, streamlined building code and zoning requirements, and special local financing programs and resources.

Christian County TIF Districts

Local incentives

Click a location to learn more

Local Incentives

Taylorville Incentives

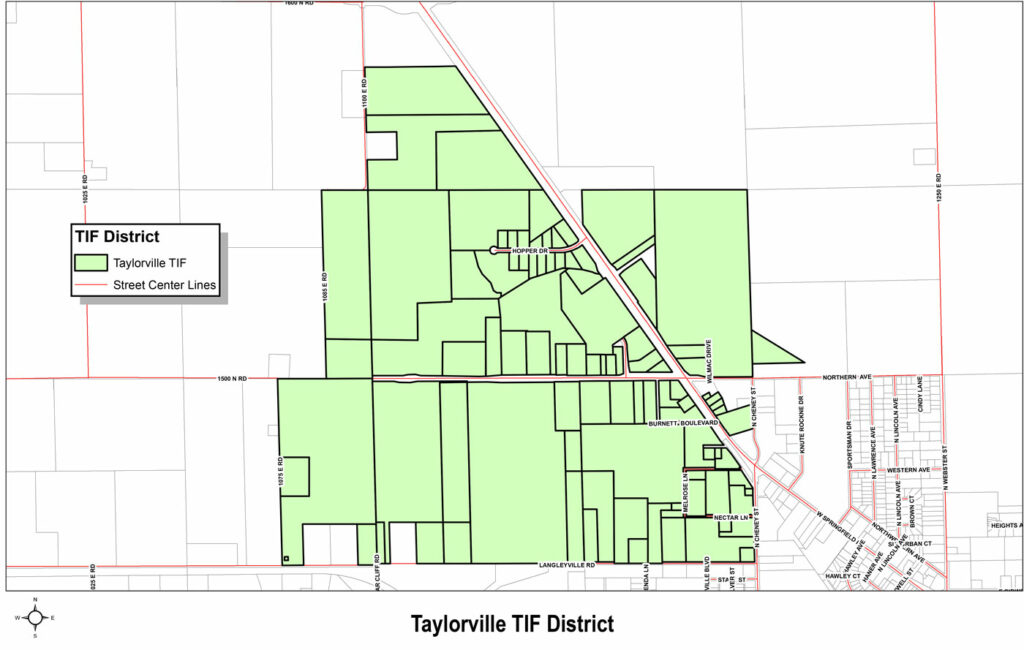

Taylorville TIF District

Description of Eligible Project Costs for a Tax Increment Financing District in Illinois

Categories of permissible redevelopment costs included in the Illinois TIF Act:

1. Costs of studies, surveys, development of plans and specifications, implementation and administration of the redevelopment plan. For example, professional service costs: architectural, engineering, legal, financial, planning; and administrative costs related to implementation of the redevelopment plan. (Private & Public)

2. Cost of marketing sites. (Private & Public)

3. Property assembly costs. For example, acquisition of land and other property, real or personal, or rights or interests therein; demolition of buildings; and site preparation. (Private & Public)

4. Costs of rehabilitation, reconstruction or repair or remodeling of existing public or private buildings. (Private & Public)

5. Costs of construction of public works or improvements. For example, streets, sidewalks, water, sanitary and storm sewer, etc.; and new public buildings (with some limitations). (Private & Public)

6. Costs of eliminating or removing contaminants and other impediments such as site improvements that serve as an engineered barrier addressing ground level or below ground environmental contamination, including parking lots and other concrete or asphalt barriers; and the clearing/grading of land. (Private & Public)

7. Costs of job training and retraining projects. (Private & Public)

8. Financing costs – up to 30% of interest expense. (Private & Public)

9. Obligations secured by the special tax allocation fund… may be issued to provide for redevelopment costs. (Public)

10. Approved Capital Costs of taxing districts. For example, all or a portion of a taxing district’s capital costs resulting from the redevelopment project necessarily incurred or to be incurred within a taxing district (including the municipality) in furtherance of the objectives of the redevelopment plan and project when approved by the municipality. (Public)

11. Relocation costs. (Private & Public)

12. Payment in lieu of taxes. (Public)

13. Up to 50% of cost of construction of low income and very low income new housing, owner occupied or rental. (Private)

© 2013 The Economic Development Group, Ltd. • Jacob & Klein, Ltd.

1701 Clearwater Avenue, Bloomington, IL 61704 / Tel: 309-664-7777 Fax: 309-664-7878

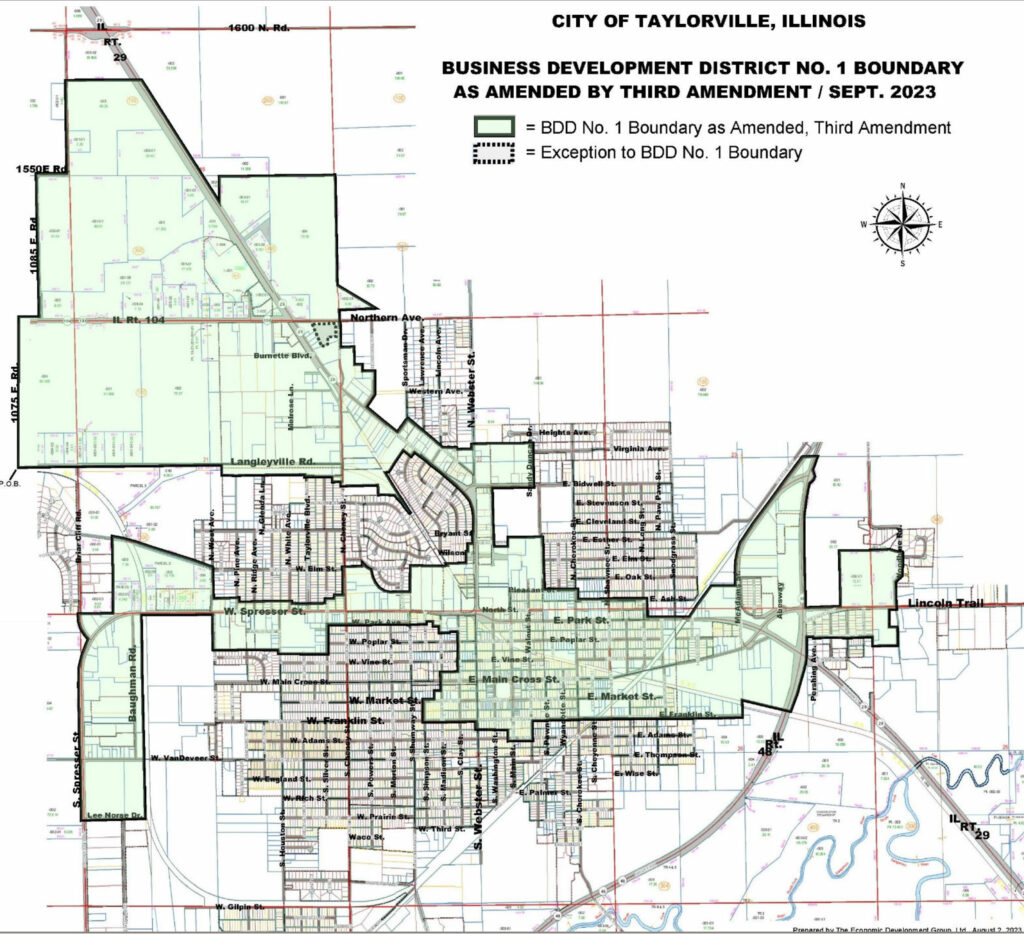

TAYLORVILLE BUSINESS DEVELOPMENT DISTRICT NO. 1

Taylorville Business Development and Redevelopment District (BDD) No. 1 is a special financing program created by the City of Taylorville to primarily encourage the expansion and development of commercial businesses within the designated BDD Area. This program enables the City to offer support for attracting development to vacant properties, and for stimulating the redevelopment, repair and renovation of existing buildings and structures.

Private Developers and investors may request a BDD APPLICATION FORM for proposed projects from the City of Taylorville by contacting the mayor’s office at 115 N. Main Street, Taylorville, IL, or call (217) 287-7946.

BDD assistance is subject to approval of a written redevelopment agreement with the Taylorville City Council. Such written agreements may provide for the reimbursement of BDD-eligible project costs by awarding matching grants, low-interest loans, forgivable loans, annual reimbursements not to exceed some predetermined cumulative amount payable over multiple years, or any combination of these terms.

BDD Funds have been specially allocated for a portion of the BDD Area relating to Downtown Redevelopment Projects that are undertaken within a nine-block sub-area defined as including and surrounding the Christian County Courthouse and bound by Webster St., Vine St., Walnut St. and Franklin St. Downtown Redevelopment Projects funded through this allocation are generally provided per the following guidelines: amounts not to exceed Fifty Percent (50%) of total project costs for Projects requiring a total verified minimum investment of $2,000 to $9,999; amounts not to exceed Thirty-Five Percent (35%) of total project costs for Projects requiring a total verified minimum investment of $10,000 to $49,999; and amounts not to exceed Twenty- Five Percent (25%) of total project costs for Projects requiring a total verified minimum investment of $50,000 or more.

Eligible Business Development District (BDD) Project Costs may include:

- Plans & Studies

- Acquisition of Land & Buildings \

- Site Preparation

- Public Infrastructure

- Renovations/Expansions of Existing Buildings

- Construction of New Buildings

- Reduced Financing Costs

- Relocation Costs

Portions of BDD No. 1 located north of Langleyville Road and west of Cheney St. are also within the Taylorville Tax Increment Financing District No. 1 Redevelopment Project Area. Projects in those areas may be eligible for both BDD and Tax Increment Financing (TIF) incentives. Please contact the City of Taylorville prior to your next commercial redevelopment project for more information and a no-obligation consultation regarding opportunities to further enhance your plans using one or more of the City’s special economic development tools.

Contact Info

Application forms are available by contacting the Office of Mayor Bruce Barry, weekdays 8:00 a.m. – 4:30 p.m. at:

Mayor Bruce Barry

Local Incentives

Pana Incentives

Pana

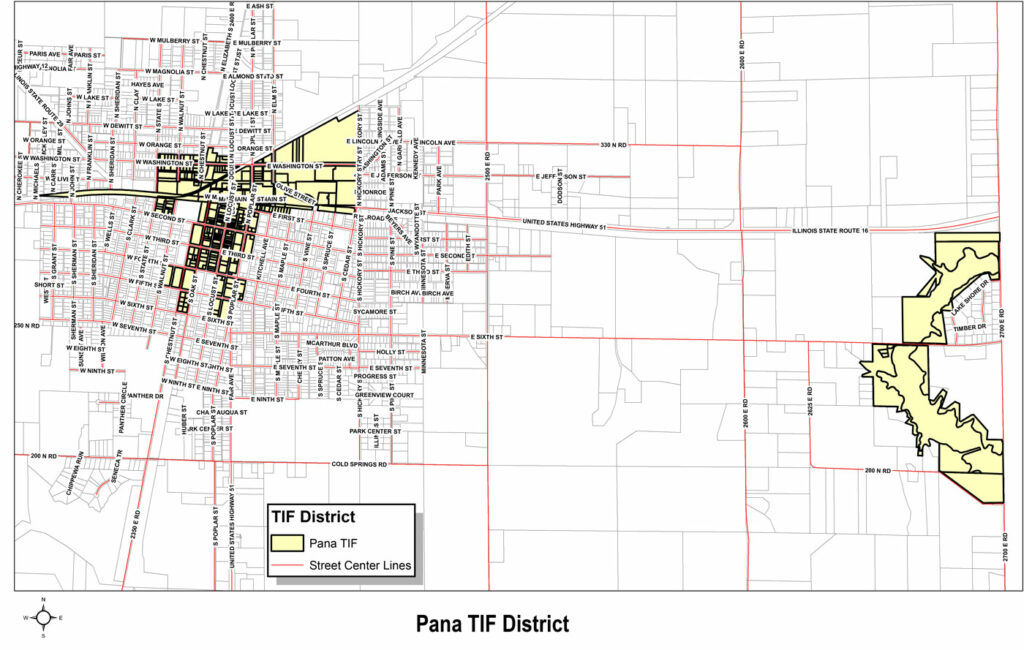

TIF District

Pana is committed to providing strong support for new businesses and current employers who wish to expand their facility and train a knowledgeable workforce. Businesses locating in the Pana may be eligible for substantial assistance programs provided through local and state incentive programs. Depending upon the specific location of your business in Pana incentives may be available through a variety of programs including Tax Increment Financing (TIF), Business Development District (BDD). As of January 2021, Pana will also be included in the Taylorville Christian County Enterprise Zone.

Pana also includes a Federal Opportunity Zone.

The program is designed to offer tax benefits for investments made into designated Opportunity Zones. Capital gains invested in the program are potentially eligible to be deferred and/or reduced, and capital gains tax deriving from the investment have the potential to be eliminated.

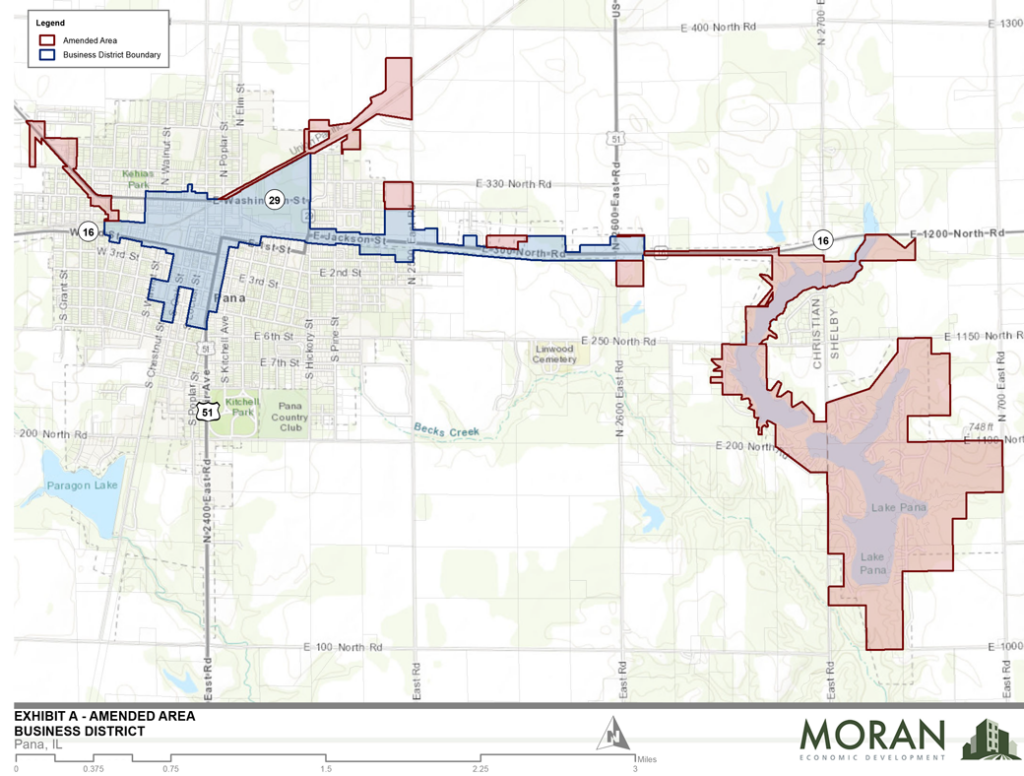

PANA BUSINESS DEVELOPMENT DISTRICT

The Pana Business District is a valuable tool for attracting and retaining businesses. The Business District was established to encourage development in Pana which would otherwise not occur. Projects should demonstrate a significant benefit by constructing public improvements in support of developments that will create new jobs, retain existing jobs, eliminate blight, and strengthen the economic base of the City of Pana.

Local Incentives

Stonington Incentives

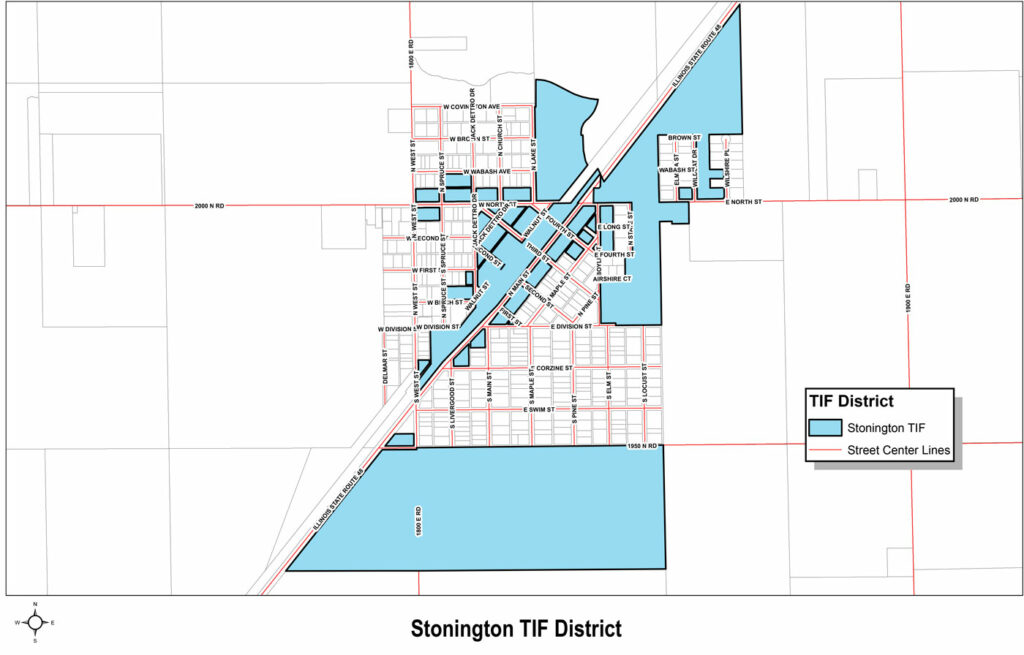

Stonington TIF District

General Policy:

While tax increment financing (TIF) is an important and useful tool in attracting and retaining businesses, it is essential that it is used appropriately to accomplish the Village’s economic development goals and objectives. The fundamental principle that makes TIF viable is that it is designed to encourage development which would not otherwise occur. The Village is responsible to assure that the project would not occur “but for” the assistance provided through TIF. It is the policy of the Village to consider the judicious use of TIF for those projects which demonstrate a substantial and significant public benefit by constructing public improvements in support of developments that will create new jobs, retain existing jobs, eliminate blight, strengthen the economic base of the Village, increase property values and tax revenues, create economic stability, and stabilize and upgrade existing neighborhoods and areas. Priority will be given to projects that meet these goals.

Policy Guidelines:

The following criteria are to be used by the Village to evaluate TIF applications:

- Each TIF applicant must demonstrate that without the use of TIF, the project is not feasible and would not otherwise be completed.

- Each TIF applicant must possess the financial and technical ability to complete and operate the project.

- Projects involving retail or commercial development that is targeted to encourage an inflow of customers from outside the Village or that will provide services that are currently unavailable or in short supply in the Village will be viewed more favorably.

- Allowable uses of TIF assistance funds include: Land acquisition, planning, legal, engineering or architectural services, Demolition of buildings and clearing of property, Construction costs of infrastructure improvements, Rehabilitation of existing structures, and financing costs. (NEW CONSTRUCTION IS NOT ELIGIBLE)

Note: The eligibility of costs does not guarantee funding. Assistance will be based on level of investment, desirability of project, impact on property value, creation of new job opportunities, extent of property improvements, and other relevant factors.

Consideration for project assistance is to be reviewed for compliance with the following requirements:

- In the case of a business, it must be in good financial standing

- The project must be located within the established TIF district

- The developer must show that without the use of public financing assistance, the project would not otherwise occur.

Approved projects will be required to enter into “redevelopment agreements” with the Village that outlines the obligations and terms of any approved work and financial assistance. Through this agreement, the business/developer agrees to complete the project and make certain improvements in exchange for financial assistance through the TIF Program. Assistance is generally awarded in the form of annual property tax reimbursements or grant payments. A business/developer cannot assume the Village will financially participate in a project. Decisions are made on a project-by-project basis and must receive Village Board approval prior to the creation of any such agreement.

© 2013 The Economic Development Group, Ltd. • Jacob & Klein, Ltd.

1701 Clearwater Avenue, Bloomington, IL 61704 / Tel: 309-664-7777 Fax: 309-664-7878

Contact Info

Village President Bruce Dowdy

Local Incentives

Assumption Incentives

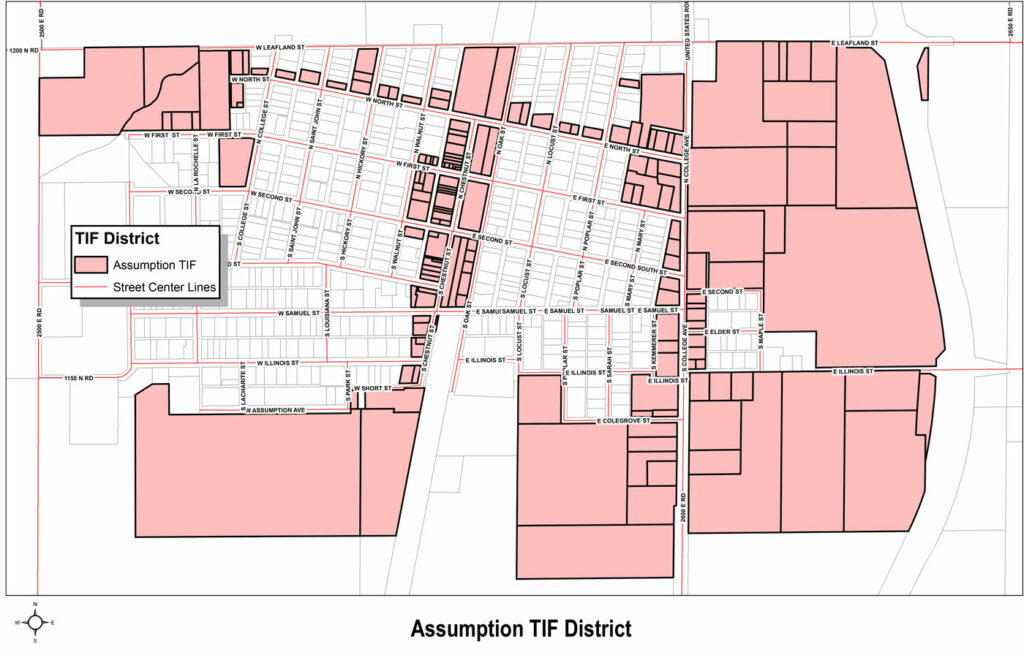

Assumption TIF District

General Policy:

While tax increment financing (TIF) is an important and useful tool in attracting and retaining businesses, it is essential that it is used appropriately to accomplish the City’s economic development goals and objectives. The fundamental principle that makes TIF viable is that it is designed to encourage development which would not otherwise occur. The City is responsible to assure that the project would not occur “but for” the assistance provided through TIF. It is the policy of the City to consider the judicious use of TIF for those projects which demonstrate a substantial and significant public benefit by constructing public improvements in support of developments that will create new jobs, retain existing jobs, eliminate blight, strengthen the economic base of the City, increase property values and tax revenues, create economic stability, and stabilize and upgrade existing neighborhoods and areas. Priority will be given to projects that meet these goals.

Policy Guidelines:

The following criteria are to be used by the City to evaluate TIF applications:

- Each TIF applicant must demonstrate that without the use of TIF, the project is not feasible and would not otherwise be completed.

- Each TIF applicant must possess the financial and technical ability to complete and operate the project.

- Projects involving retail development that is targeted to encourage an inflow of customers from outside the City or that will provide services that are currently unavailable or in short supply in the City will be viewed more favorably.

- Allowable uses of TIF assistance funds include: Land acquisition, Planning, legal, engineering or architectural services, Demolition of buildings and clearing of property, Construction costs of infrastructure improvements, Rehabilitation of existing structures and financing costs.

The City enters into “redevelopment agreements” with businesses that either locate or make substantial improvements within the TIF district. Through this agreement, the business agrees to complete the project and make certain improvements. A business cannot assume the City will financially participate in the project. Decisions are made on a project-by-project basis and must receive City Council approval before the staff can process any assistance.

Consideration for project assistance is to be reviewed for compliance with the following requirements:

- The business must be a “for profit” business in good financial standing

- The business must be located within the established TIF district

- The business must show the financial capability to complete the proposed project

State Incentives

Sales Tax Exemption

A 6.25 percent state sales tax exemption is permitted on building materials to be used in an Enterprise Zone. Materials must be permanently affixed to the property and must be purchased locally.

Enterprise Zone Machinery and Equipment Consumables / Pollution Control Facilities Sales Tax Exemption

A 6.25 percent state sales tax exemption on purchases of tangible personal property to be used in the manufacturing or assembly process or in the operation of a pollution control facility within an Enterprise Zone is available. Eligibility is based on a business making an investment on an Enterprise Zone of at least $5 million that creates a minimum of 200 full-time-equivalent jobs, a business investing at least $40 million in a zone and retaining at least 2,000 jobs, or a business investing at least $40 million in a zone which causes the retention of at least 90 percent of the jobs existing on the date it is certified to receive the exemption.

Enterprise Zone Utility Tax Exemption

A state utility tax exemption on gas, electricity and the Illinois Commerce Commission’s administrative charge is available to businesses located in Enterprise Zones. Eligible businesses must make an investment of at least $5 million that creates a minimum of 200 full-time-equivalent jobs in Illinois, or an investment of $20 million that retains at least 1,000 full-time-equivalent jobs in Illinois. Most of the jobs created must be located in the Enterprise Zone where the investment occurs.

Enterprise Zone Investment Tax Credit

A state investment tax credit of 0.5 percent is allowed to a taxpayer who invests in qualified property in a Zone. Qualified property includes machinery, equipment, and buildings. The credit may be carried forward for up to five years. This credit is in addition to the regular 0.5 percent investment tax credit, which is available throughout the state, and up to 0.5 percent credit for increased employment over the previous year.

Dividend Income Deduction

Individuals, corporations, trusts, and estates are not taxed on dividend income from corporations doing substantially all their business in an Enterprise Zone.

Jobs Tax Credit

The Enterprise Zone Jobs Tax Credit allows a business a $500 credit on Illinois income taxes for each job created in the Zone for which a certified eligible worker is hired. The credit may be carried forward for up to five years. A minimum of five workers must be hired to qualify for the credit. The credit is effective for people hired on or after January 1, 1986.

Interest Deduction

Financial institutions are not taxed on the interest received on loans for development within an Enterprise Zone.

Contribution Deduction

Businesses may deduct double the value of a cash or in-kind contribution to an approved project of a designated Zone organization from taxable income.